Vietnam’s steel industry is undergoing a significant transformation — not only aiming for growth but also for sustainable development. At the 6th Congress of the Vietnam Steel Association (VSA), the commitment to achieve Net Zero by 2050 was officially established as a core strategic direction. Tay Nam Steel is not standing aside; the company is taking clear, deliberate steps to join the industry’s green transition journey.

Vietnam’s Steel Industry Progresses Step by Step Toward Green Standards

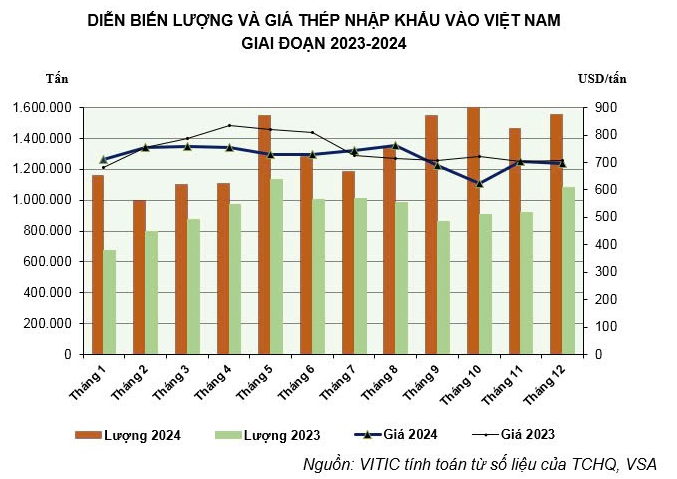

At the 6th Congress of the Vietnam Steel Association (VSA) held in May 2025, the report showed that Vietnam’s domestic steel consumption reached over 24.5 million tons in 2024 — the highest level in the past decade. From 2019 to 2024, the total volume of finished steel products surpassed 176 million tons, reflecting the industry’s impressive growth momentum.

However, this rapid growth also comes with significant challenges. The steel industry is currently among the largest sources of CO₂ emissions. At the same time, green trade barriers such as CBAM (Carbon Border Adjustment Mechanism) from the EU have started taking effect, requiring Vietnamese steel manufacturers to adopt clear emission reduction pathways in order to maintain their export capacity and global integration.

(Source: Ministry of Industry and Trade)

VSA Sets Net Zero Target and Recommends Concrete Actions

At the 6th Congress, VSA set a clear vision: Vietnam’s steel industry will aim for carbon neutrality (Net Zero) by 2050. To achieve this goal, the association recommends that businesses take the following actions:

- Transition to Electric Arc Furnace (EAF) technology to reduce dependence on blast furnaces

- Apply Carbon Capture, Utilization, and Storage (CCUS) technologies

- Increase the use of recycled materials and renewable energy

- Conduct greenhouse gas inventories and product life cycle assessments, following international standards such as ISO 14064-1:2018 and ISO SO14067:2018.

- Implementing these standards not only enhances a company’s competitiveness but also ensures compliance with the strict environmental requirements of major export markets.

Tay Nam Steel Takes Green Action with Dual ISO Certification

Recognizing the urgent need for transition, Tay Nam Steel has proactively developed a roadmap for environmentally friendly production — focusing not only on technological upgrades but also on the standardization of its operating processes.

Since 2023, Tay Nam Steel has officially implemented CBAM reporting, marking an important step in adapting to global carbon emission regulations, particularly in the European market.

In June 2025, the company made further progress by earning two key international certifications:

ISO 14064-1:2018 – Greenhouse gas emissions inventory

ISO 14067:2018 – Product carbon footprint assessment

These certifications represent a meaningful milestone in Tay Nam Steel is journey toward sustainable manufacturing. We are committed to working alongside our customers to create green, resilient, and future-ready construction projects that align with modern living and global environmental trends.

Stay tuned to Tay Nam “Steel Industry News” section for the latest updates on the steel market!

#Taynamsteel

#SteelIndustryNews

#SustainableGrowth

#ISOcertification

#GreenManufacturing

#BuildingMaterials

#SteelIsUs