(Tay Nam Steel) – April 9, 2025 – As 2024 draws to a close, Vietnam’s steel industry is showing strong signs of recovery after a prolonged period of stagnation. The rebound in both domestic and international markets, combined with government stimulus policies for public investment, has created a positive momentum for the entire sector. Amid this landscape, Tay Nam Steel has proactively restructured its production and business operations, ready to break through in 2025 with a flexible strategy and long-term vision.

After a prolonged downturn during 2022–2023, Vietnam’s steel industry began showing clear signs of recovery in early 2024 and is expected to make a strong comeback in 2025. This is a positive signal not only for major corporations but also opens up growth opportunities for steel producers and distributors across the country.

Production and consumption on the rise

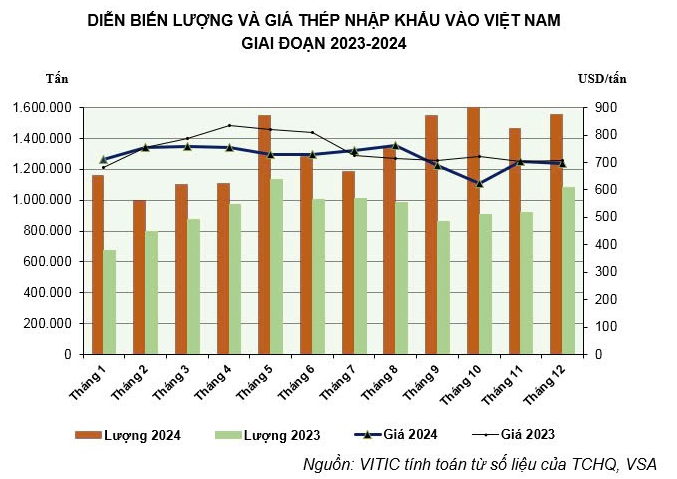

According to data from the Vietnam Steel Association (VSA), in Q1 2024, the output of finished steel reached 7.06 million tons, up 5.5% year-on-year. Meanwhile, domestic steel consumption rose sharply to 6.68 million tons, a 10% increase. Notably, steel exports recorded an impressive 36% growth, reaching 2.25 million tons.

Domestic steel prices show strong recovery

Notably, domestic steel prices have rebounded from multi-year lows and stabilized around VND 14 million per ton. Specifically, the price of CB240 rolled steel has increased by approximately VND 910,000 per ton over just five months.

Protective policies fuel growth for local enterprises

At the end of October 2024, the Ministry of Industry and Trade officially extended anti-dumping duties on color-coated steel imports from China and South Korea for an additional five years. This move reduces competitive pressure and creates favorable conditions for domestic companies to boost production and expand their market share.

At the same time, the Vietnamese Government is ramping up public investment in transport infrastructure, thereby stimulating domestic steel demand. Experts forecast that steel consumption in Vietnam will increase by 14% in 2024 and continue to grow by another 11% in 2025.

Tay Nam Steel actively embraces the recovery trend

In response to these promising market signals, Tay Nam Steel has proactively prepared for the upcoming growth phase. The company is currently focusing on:

Optimizing production lines for galvanized and color-coated steel

Expanding partnerships with major distributors and construction contractors

Enhancing market forecasting and swiftly responding to raw material price trends

Tay Nam Steel anticipates that 2025 will be a breakthrough year, as the steel market enters a new growth cycle in parallel with a strong recovery in the real estate and infrastructure development sectors.

#TayNamSteel

#BuiltToLast

#SteelIndustryNews

#GalvanizedSteel

#SteelTrends